Table of Contents

Togglewhat is Forex trading?

Forex trading is the conversion of one currency into another. Also referred to as foreign exchange or FX trading, this type of transaction always happens. For example, each day somewhere around $6.6 trillion worth of forex trades are made on international markets where different currencies interact. It’s thus clear that Not all of these massive rises and falls will be caused by companies, however, put it into perspective, forex trading is one of the most actively traded markets in the world. Every day individuals, companies, and banks carry out around $6.6 trillion in forex trades (source: BIS).

FOUR MAIN TYPES OF CURRENCY PAIRS TRADED GLOBALLY

1. Major pairs:

comprising around 80% of daily trade volume, including the euro versus the US dollar, the dollar versus the Japanese yen, the British pound versus the dollar, and the Swiss franc versus the dollar

2. Minor pairs:

Featuring less frequent trading activity, often pit a major currency opposite another major currency other than the dollar, such as the pound versus the Canadian dollar or the euro versus the Swiss franc.

3. Exotics pairs:

Then there are the so-called exotic pairs, where a major currency is traded against the currency of a smaller or emerging economy, like the dollar against the Mexican peso or the euro against the South African rand.

4. Regional pairs:

The final category encompasses regional pairs classified by geographic region, such as pairs between Scandinavian currencies or between Australian and New Zealand dollars and other Asian currencies. Whether undertaken by financial institutions, companies, or individuals, most forex transactions aim to purchase one currency expected to appreciate relative to the currency simultaneously sold. However, any conversion of one money into another performed while traveling abroad also represents a foreign exchange transaction.

Most forex transactions are carried out by banks or individuals by seeking to buy a currency that will increase in value against the currency they sell. However, if you have ever converted one currency into another, for example, when traveling, you have made a forex transaction.

How does forex trading work?

Big banks and companies trade foreign currencies with each other in a market without a central place. This differs from stock trading, which happens on specific exchanges. Instead, the big-time forex market works through a worldwide network of banks and other groups.

Deals take place in four main forex trading hubs spread across different time zones: London, New York, Sydney, and Tokyo. The lack of a central location allows forex trading to happen around the clock.

Most forex traders don’t receive the currency they trade. Instead, they try to profit from changes in exchange rates by guessing where prices will go. One popular way to do this is through derivative trading. This lets you bet on price changes without owning the actual currency. For instance, when you trade forex with xyz, you predict which way a currency pair’s price will move. How well you guess determines if you make money or lose it.

THREE DIFFERENT TYPES OF FOREX MARKET:

Spot forex market: the physical exchange of a currency pair, which takes place at the exact point the trade is settled – i.e ‘on the spot’ – or within a short period. Derivatives based on the spot forex market are offered over the counter by dealers.

Forward forex market: a contract is agreeing to buy or sell a set amount of a currency at a specified price, and to be settled at a set date in the future or within a range of future dates

Futures forex market: an exchange-traded contract to buy or sell a set amount of a given currency at a set price and date in the future.

FOREX PRICING—BASE AND QUOTE CURRENCY:

Base currency: The currency you are buying when you trade the forex pair.

Quote Currency:

The currency you are selling when you are trading the Forex pair.

In the above example, GBP is the base currency and USD is the quote currency. If GBP/USD is trading at 1.35361, then one pound is worth 1.35361 dollars.

If the pound rises against the dollar, then a single pound will be worth more dollars and the pair’s price will increase. If it drops, the pair’s price will decrease. So, if you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair (going long). If you think it will weaken, you can sell the pair (going short).

What is leverage in forex trading?

What is margin in forex trading?

What is a pip in forex trading?

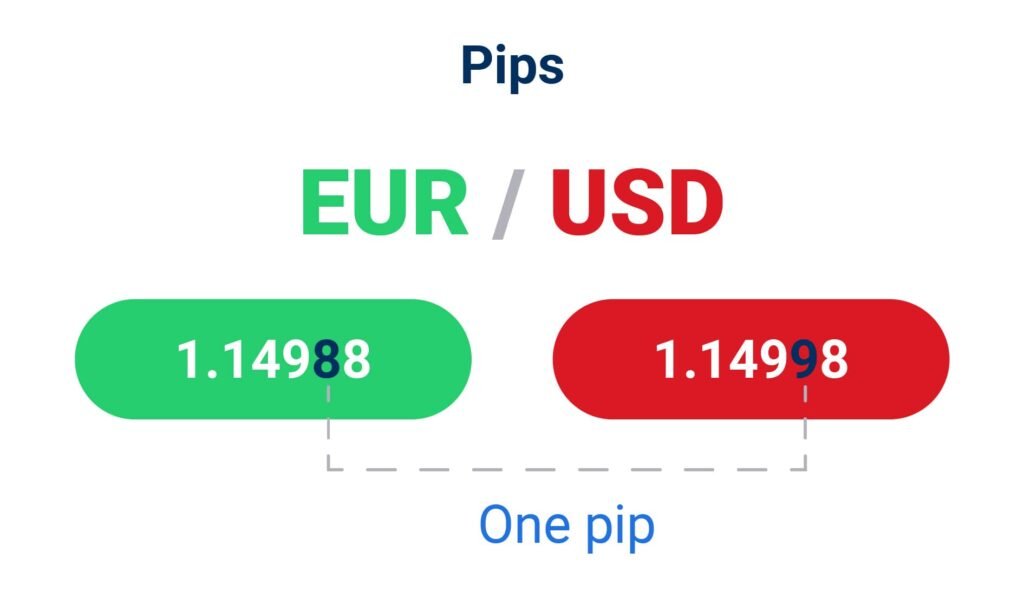

Pips are the units used to measure movement in a forex pair. A forex pip usually refers to a movement in the fourth decimal place of a currency pair. So, if EUR/USD moves from $1.14988 to $1.14998, then a single pip has moved. The decimal places that are shown after the pip are called micro pips or sometimes pipettes, and represent a fraction of a pip.

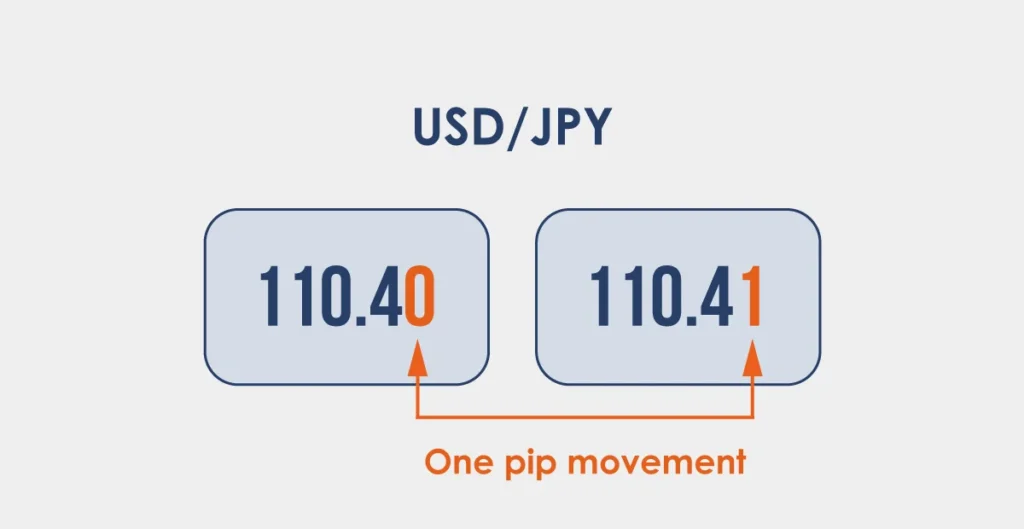

The exception to this rule is when the quote currency is listed in much smaller denominations, with the most notable example being the Japanese yen. Here, a movement in the second decimal place constitutes a single pip. So, if USD/JPY moves from 110.40 to 110.41, it has moved a single pip.

What is the spread in forex trading?

In forex trading, the spread is the difference between the buy and sell prices quoted for a forex pair. If, for instance, the buy price on EUR/USD was 1.7645 and the sell price was 1.7649, the spread would be four pips.

If you want to open a long position, you trade at the buy price, which is slightly above the market price. If you want to open a short position, you trade at the sell price—slightly below the market price.